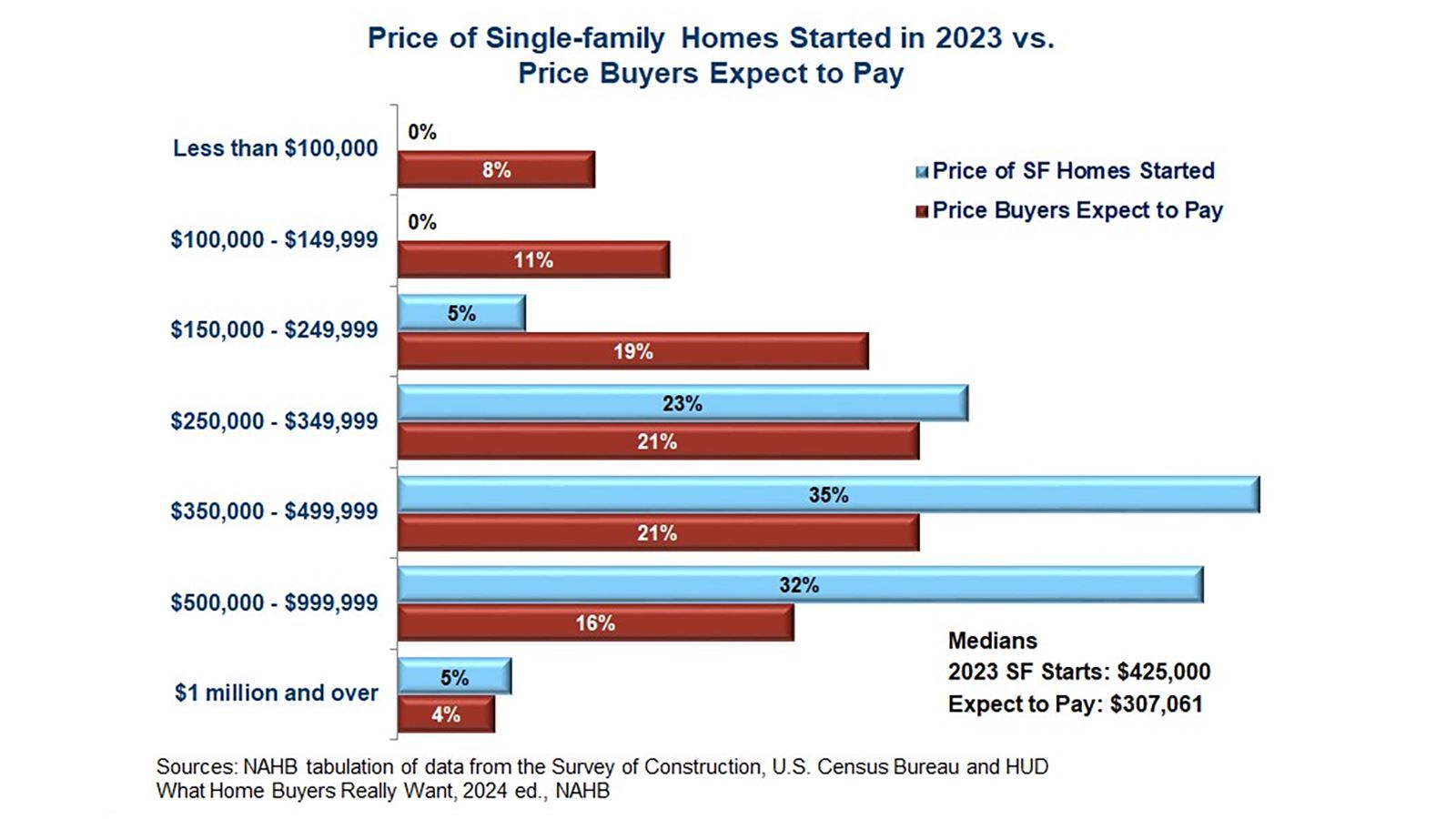

What Buyers Expect to Pay vs. Actual Home Prices

Home Price Expectations Clash with Reality, According to NAHB and Census Bureau

There is a major gap between buyers’ expectations and home prices, according to recent surveys from NAHB and the U.S. Census Bureau.

While 38% of buyers expect to pay less than $250,000 for their next home, only 5% of homes that started construction in 2023 are actually priced under $250,000.

In contrast, the share of new homes being built that sell for above $250,000 is often far greater than the share of buyers seeking homes in that price range.

The chart below illustrates this contrast.

Single-Family Prices vs Buyer Expectations

For new homes priced below $250,000, the red bars are longer than the blue bars, indicating that the share of prospective and recent buyers exceeds the share of new homes being built in those price ranges. Above $250,000, the opposite is true. The blue bars are longer than the red bars, indicating that the share of homes being built exceeds the share of buyers in the market at those prices.

While existing homes in the starter market have traditionally consisted of the bulk of sales for buyers with modest incomes, the supply of homes in the resale market have been running at historically low levels for several years and prices of existing homes have been setting record highs. Indeed, the median price of an existing home in May was well over $400,000. A major part of the reason for this limited existing inventory is due to the interest rate “lock-in effect,” where home owners are reluctant to sell their home because their current mortgage rate is well below market rates.

Another large part of the explanation for the actual versus expected price mismatch is the cost of new home construction. Residential construction wages continue to rise. Although prices of many residential building materials have been stable recently, the stability comes after massive increases in the two years following the onset of the COVID pandemic. A shortage of lots has been a chronic issue since the home building industry started to recover from the Great Recession.

Moreover, regulatory costs can be substantial. NAHB’s latest study on the topic shows regulation accounting for $93,870 of the cost of an average new single-family home. The largest regulatory cost impact, $24,414, comes from changes to building codes over the past 10 years. This is followed by $12,184 in fees paid by the builder after purchasing the lot, $11,791 in regulatory costs incurred by the developer during site work, $10,854 in the value of land that must be purchased and dedicated to the government or otherwise left unbuilt, and $10,794 in required architectural details that exceed what the builder would ordinarily do.

SHARE